Presenting the best investor education content, #CuratedByKuvera.

In this video by @DSP Mutual Fund you will understand the significance of mutual funds, types of mutual funds, factors to consider while investing in a mutual fund, and much more! Watch the video to know more!

What are mutual funds?

A mutual fund is a professionally managed portfolio of stocks, bonds, and other income vehicles dedicated to a particular investment strategy or asset class. When investors purchase shares in a mutual fund investment, the money is pooled and invested on their behalf by the mutual fund company.

Types of mutual funds

There are numerous types of mutual funds on the market. However, if you are a beginner, you may have difficulty selecting one. To help you understand more, we've listed a few different types of mutual funds based on their investment goals.

Equity Funds: An equity mutual fund, also referred to as a stock fund, invests entirely in corporate stocks. The most common type of mutual fund is an equity fund. As you are invested in a large number of stocks, it allows you to diversify your portfolio.

Money market funds: Typically, these mutual funds invest in low-risk debt securities. Certificates of deposit (CDs), commercial paper, repurchase agreements, and other investments are common in money market funds.

Balanced funds: A balanced fund, also referred to as a hybrid fund, invests in a diverse portfolio of stocks, bonds, and other assets. They offer even more diversification than traditional equity or fixed-income fund.

Growth Funds: These funds are designed for investors with a high-risk tolerance and are focused on long-term capital appreciation.

Liquid Funds: These funds invest in money market instruments and are excellent short- and ultra-short-term liquidity sources.

Income funds: Their primary goal is to provide regular income to investors through dividends or coupons.

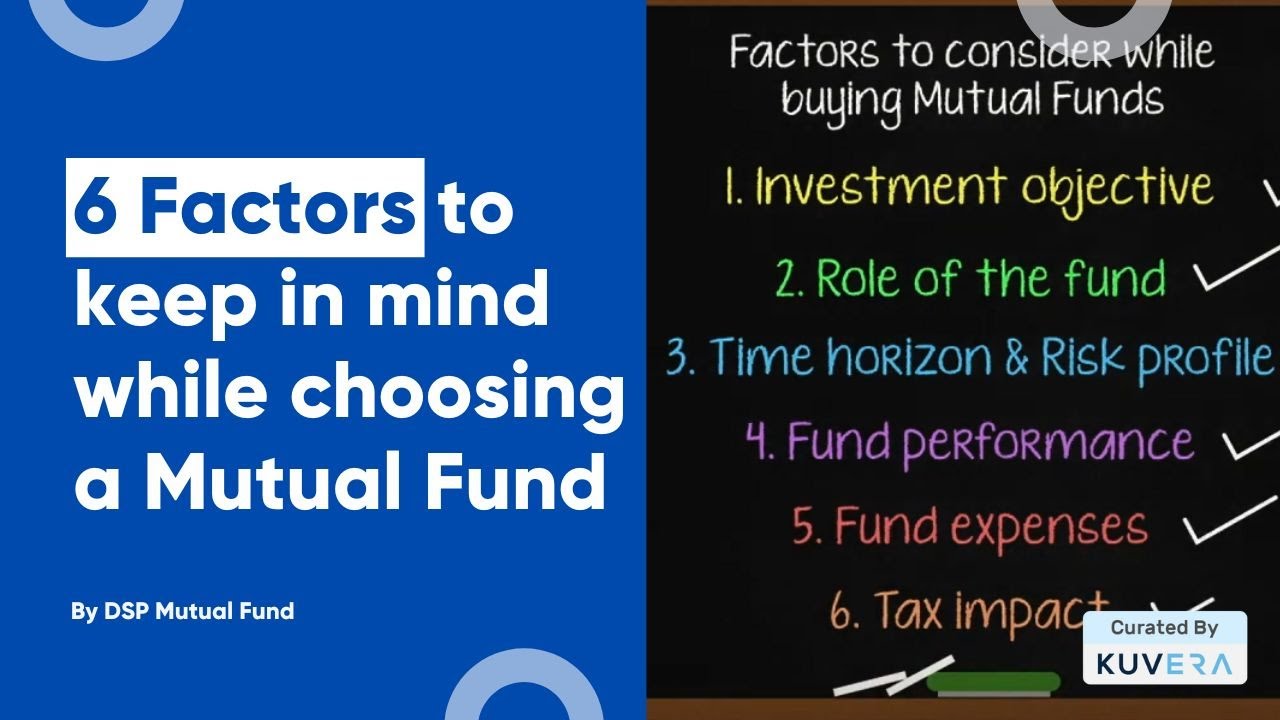

Factors to keep in mind while choosing a mutual fund

Goals: What do you hope to get from your mutual fund investment? Are you saving for retirement, college for your children, or investing for future generations? The answers to these questions can assist you in narrowing down which funds would be most beneficial.

Time Horizon: Long-term investors are typically better served by mutual funds. A mutual fund may not be the best option if you believe you will need your money in the next three to five years. This is because the return in that amount of time, once fees are deducted, may not be sufficient to justify the investment.

Risk tolerance: Evaluate your level of risk tolerance and invest accordingly. Understanding your risk tolerance can help you choose funds with appropriate strategies and asset allocations.

Expense ratio: After deciding on a mutual fund category, one must select a mutual fund plan. However, a mutual fund investor should be aware that fund houses charge an investor for managing their portfolio, referred to as the expense ratio.

NAV: When selecting a mutual fund plan, investors should consider the plan's Net Asset Value (NAV). Lower NAV may result in a higher return. However, an investor should consider the plan's track record and fund management in addition to NAV.

Category Selection: Choosing the Best Mutual Fund by Category can sometimes be difficult. To make the process easier, look at the table below to see how funds are classified as Low, Mid, and High Risk.

List of mutual funds you can invest in 2022

The best-performing mutual funds are classified into several types. We can categorise mutual funds based on their underlying assets, such as equity, debt, or gold, into equity mutual funds, debt mutual funds, and hybrid funds. These funds have varying risk profiles and investment goals. List of best mutual funds one can invest in covers ICICI mutual fund, Aditya Birla mutual fund, HDFC mutual fund, Kotak mutual fund, SBI mutual fund. Among these, DSP mutual fund is considered one of India's best mutual funds.

Conclusion

Among other investments, mutual funds have become the most popular in recent years. Choosing the best mutual fund returns allows you to save for future financial goals while not putting too much strain on your finances.

If you haven't already started your investing journey, click on the link to 'Kuvera - Your Safe Space to Invest': https://bit.ly/3JTbcJq

6 Factors To Keep In Mind While Choosing A Mutual Fund || Best Of Investor Education

ZAL

October 15, 2022

Popular Posts

Doors Concepts - How to get ALL 5 BADGES! [ROBLOX]

November 21, 2022

Car - The Automobile | Character Showcase! (Repentance Mod)

April 09, 2022

Plus Two Maths Exam Model Questions | Chapter 8 to 11|🔥💯

April 09, 2022

Recent

6/recent/post-list

HOT

6/random/post-list

0 Comments